From Lifestyle to Regulation: The 2026 Rise of Sober Markets and Japan’s Premium Export Strategy How Two Emerging Power Markets...

Table of Contents

Japan’s demographic decline has reached a scale where it is now treated as a quantifiable economic constraint, not a future risk. In 2025, official government data shows that population contraction is directly reducing labour supply, suppressing potential GDP growth, and intensifying productivity pressure. As a result, Japanese policy has pivoted toward two measurable responses: accelerating productivity through technology and expanding foreign direct investment as a structural supplement to domestic human capital.

For international businesses, these numbers explain why Japan’s investment stance is changing now.

According to the Cabinet Office of Japan, Japan’s total population has been declining every year since 2009. In 2024, the working-age population aged 15 to 64 fell to approximately 73.9 million, down from over 87 million in the mid-1990s.

Government projections show that by 2040, Japan’s labour force could shrink by a further more than 10%, creating a structural gap that cannot be filled by domestic labour alone.

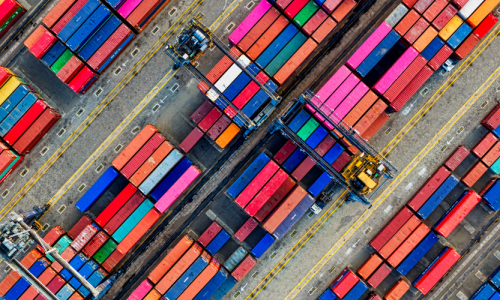

The Ministry of Health, Labour and Welfare reports that labour shortages are now evident across manufacturing, healthcare, logistics, construction, and services. In its 2024 Labour White Paper, the ministry explicitly states that declining labour input will lower potential economic growth unless productivity rises significantly.

The OECD estimates that Japan’s potential GDP growth rate could fall below 0.5% annually in the long term if productivity does not improve enough to offset demographic decline.

Japan’s policy response is measurable and investment driven.

Foreign companies are explicitly positioned as carriers of capital, advanced technology, and specialised talent that Japan increasingly lacks domestically.

Japan’s demographic decline is now driving concrete economic policy. With a shrinking workforce and measurable productivity constraints, the government is actively aligning technology policy and foreign investment strategy to sustain growth. For international businesses, this signals a more open and opportunity-driven environment, particularly in technology, automation, and high-value services.

VenturesLink supports international firms in understanding Japan’s policy direction, identifying market opportunities, and navigating market entry in a rapidly changing economic landscape. Reach out to explore how your business can engage with Japan’s evolving investment priorities.

Cabinet Office of Japan Economic Analysis

https://www5.cao.go.jp/j-j/wp/wp-je08/08b03010.html

Ministry of Health, Labour and Welfare Labour White Paper

https://www.mhlw.go.jp/stf/wp/hakusyo/roudou/24/2-2.html

OECD Addressing Demographic Headwinds in Japan

https://www.oecd.org/economy/addressing-demographic-headwinds-in-japan.htm

Japan External Trade Organization Investment Policy

https://www.jetro.go.jp/en/invest/whyjapan.html

From Lifestyle to Regulation: The 2026 Rise of Sober Markets and Japan’s Premium Export Strategy How Two Emerging Power Markets...

A New Era for Japan’s Workforce: Reskilling Reform and the Business Advantage Japan is advancing a series of workforce transformation...

Reasons Why Japan’s Konbini Win Hearts and Command Markets Japanese convenience stores, known as konbini, represent one of the most advanced...

A New Map for Japan Market Entry Introduction: A Market with Two Gateways A quiet transformation is unfolding across Japan,...

The 2026 Roadmap: Japan’s Most Attractive Sectors for Global Investors Japan is entering 2026 with a rare combination of economic...

Overview of Japan Import Regulations Did you know that a single missing comma on a Japanese customs form can delay...

When Do You Need a Licensed Importer or Local Representative in Japan? Imagine your products are sitting at a Japanese...

Japan’s Green Transformation Opportunity and How KizunaX Supports New Entry Path for Your Company Japan is entering a decisive phase...

When Do You Need a Licensed Importer or Local Representative in Japan? Imagine your products are sitting at a Japanese...