From Lifestyle to Regulation: The 2026 Rise of Sober Markets and Japan’s Premium Export Strategy How Two Emerging Power Markets...

Table of Contents

In 2026, two powerful global forces have moved far beyond lifestyle trends and into the arena of major regulated industries. The “Social but Sober” movement is reshaping the global beverage and hospitality sectors, while Japan’s ambitious Premium Export drive is transforming the nation’s role in international trade. Together, these shifts are creating new investment pathways that promise high returns but also require precise regulatory and strategic navigation.

What began as a cultural shift toward mindful drinking has become a significant business category. The sober-curious lifestyle, once niche, now shapes the beverage and nightlife industries as Millennials and Gen Z increasingly choose sophisticated non-alcoholic options that allow socializing without intoxication.

By 2026, the non-alcohol and low-alcohol beverage sector has grown into a strategic global market. Premium non-alcoholic beers, wines, spirits, and functional mocktails continue to surge in demand, prompting both major beverage corporations and boutique producers to expand their offerings. The category is no longer supplemental. It is a central to product strategy.

Governments have responded with new labeling standards, taxation updates, and ingredient regulations across regions such as Japan, South Korea, Australia, and the EU. These rules now mirror those applied to alcoholic beverages, especially as non-alcoholic products become major revenue generators. The rise of functional beverages with adaptogens, botanicals, or CBD adds further regulatory complexity, requiring companies to align with specialized health and wellness guidelines while adapting to rapidly evolving consumer expectations.

Japan, long known for high-quality manufacturing, is now pushing aggressively into the export of premium lifestyle, agricultural, and cultural products. The government has established significant national targets for expanding these exports and has invested in programs that support producers, exporters, and international partners.

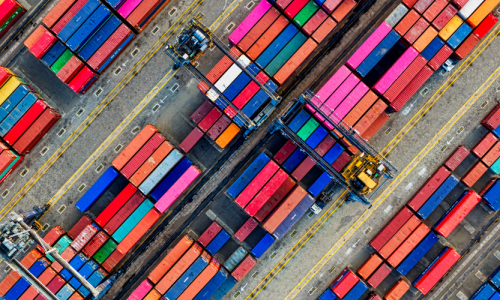

In 2025 and continuing into 2026, Japan achieved record numbers in agriculture, fishery, and food exports. Demand from the United States, Southeast Asia, and Europe continues to grow as international consumers increasingly appreciate Japanese premium goods for their craftsmanship, purity, and heritage value. Behind this success is a coordinated government strategy. Ministries such as MAFF, METI, and MOFA, along with organizations including JETRO, have launched export consultation centers, trade promotion missions, certification programs, and branding initiatives like “Delicious Japan.” These efforts support not only food producers but also companies in sectors such as traditional crafts, premium beverages, functional foods, sustainable materials, and wellness products.

This Premium Export strategy does not only focus on economic gain. It also supports Japan’s broader geopolitical and cultural goals, strengthening its global influence through soft power and quality-driven branding. However, the expansion comes with strict rules. Exporters must comply with detailed product standards, certification systems, customs documentation, packaging requirements, and market-specific regulations. For foreign investors, this creates both opportunity and complexity. Entering Japan’s premium export ecosystem requires a deep understanding of regulatory frameworks, partner networks, government support programs, and cultural business expectations.

The intersection of rising sober-lifestyle demand and Japan’s growing strength in premium exports is opening the door to innovative business opportunities. Categories such as non-alcoholic beverages, wellness-focused products, traditional Japanese crafts, specialty foods, and functional goods are becoming increasingly appealing to global investors.

Yet each category is heavily shaped by regulatory standards, government funding structures, cross-border compliance, and evolving consumer expectations. The businesses that succeed in these markets will be those that combine product quality with regulatory precision, optimized supply networks, and credible local partnerships.

This is where KizunaX provides unique value.

KizunaX is positioned as a strategic gateway for international businesses seeking to enter Japan’s regulated and rapidly growing sectors. With deep expertise in market intelligence, regulatory navigation, and cross-cultural business alignment, the company helps foreign investors avoid costly missteps and accelerate market success.

KizunaX assists businesses in several critical ways.

Through these services, KizunaX acts as a cultural, strategic, and regulatory bridge, enabling foreign investors to enter Japan’s premium export and sober-lifestyle markets without unnecessary friction.

By 2026, both the “Social but Sober” movement and Japan’s Premium Export drive have become structured, high-value business fields shaped by regulation, global demand, and cultural momentum. Investors who understand these dynamics and build the right relationships will benefit from sectors that promise strong long-term growth.

However, success requires deep knowledge of Japanese systems, global compliance landscapes, and rapidly changing consumer expectations. With its specialized expertise and strong local networks, KizunaX is ideally positioned to support foreign investors and business leaders entering these promising markets.

The Social but Sober movement refers to the rising global preference for non-alcoholic and low-alcohol beverages. It has become a major commercial sector due to shifting consumer behavior, health awareness, and regulatory developments. Investors are paying attention because the category now includes premium-priced products, functional beverages, and global distribution opportunities.

Japan is targeting high-value exports such as premium foods, agricultural products, and cultural goods to strengthen economic resilience and global influence. The government set aggressive export goals supported by official programs, certifications, and overseas promotion campaigns. This makes Japan’s premium export sector attractive but also regulated and complex.

Both sectors involve strict standards. Non-alcoholic beverages face labeling rules, ingredient compliance, and health-related regulation. Japanese exports must meet domestic certification and foreign import requirements. As these industries grow in value, governments worldwide are putting tighter policies in place to protect consumers and ensure product quality.

Success often requires forming partnerships with Japanese producers, understanding government programs, complying with export certifications, and adapting to cultural business expectations. Companies like KizunaX help investors navigate local regulations, identify trusted partners, and build long-term strategies aligned with Japan’s export initiatives.

KizunaX provides market intelligence, regulatory guidance, and relationship-building support for brands seeking entry into Japan or looking to source Japanese products. Whether launching a new non-alcoholic beverage or exploring functional ingredients, KizunaX offers strategic insights and local connections essential for compliance and growth.

Absolutely. Many Japanese producers and regional businesses are actively seeking international partners. Smaller companies with innovative products or branding often excel in premium and sober markets because they can adapt quickly and differentiate themselves. KizunaX can help match these companies with the right Japanese collaborators.

Yes, non-alcoholic sake exists, and it’s surprisingly popular. But here’s the fun part: legally, many countries don’t classify it as “sake” because sake is defined as an alcoholic product. So depending on the market, it might be labeled as a “rice beverage,” “sake-style drink,” or even “fermented soft drink.”

The good news? Consumers love it anyway, and it fits perfectly into both the sober trend and Japan’s premium export category.

From Lifestyle to Regulation: The 2026 Rise of Sober Markets and Japan’s Premium Export Strategy How Two Emerging Power Markets...

A New Era for Japan’s Workforce: Reskilling Reform and the Business Advantage Japan is advancing a series of workforce transformation...

Reasons Why Japan’s Konbini Win Hearts and Command Markets Japanese convenience stores, known as konbini, represent one of the most advanced...

A New Map for Japan Market Entry Introduction: A Market with Two Gateways A quiet transformation is unfolding across Japan,...

The 2026 Roadmap: Japan’s Most Attractive Sectors for Global Investors Japan is entering 2026 with a rare combination of economic...

Overview of Japan Import Regulations Did you know that a single missing comma on a Japanese customs form can delay...

When Do You Need a Licensed Importer or Local Representative in Japan? Imagine your products are sitting at a Japanese...

Japan’s Green Transformation Opportunity and How KizunaX Supports New Entry Path for Your Company Japan is entering a decisive phase...

When Do You Need a Licensed Importer or Local Representative in Japan? Imagine your products are sitting at a Japanese...